Aug 7/2022

On this special bonus episode of the This is Money Podcast, Rob Morgan, chief analyst at Charles Stanley Direct, joins Simon Lambert to answer the big questions that have emerged from last week's Budget. On this podcast, Simon and Rob cover among other things. Pensions and inheritance tax: Who will be caught out What can[...]

On this special bonus episode of the This is Money Podcast, Rob Morgan, chief analyst at Charles Stanley Direct, joins Simon Lambert to answer the big questions that have emerged from last week's Budget. On this podcast, Simon and Rob cover among other things. Pensions and inheritance tax: Who will be caught out What can[...] Rachel Reeves' maiden Budget this week saw the first-ever female chancellor make £40billion of sweeping tax rises to plug funding gaps, everywhere from the NHS and schools. While it left many of us with something to be miserable about when it comes to our money, there were also some important dodged bullets, as Simon Lambert,[...]

Rachel Reeves' maiden Budget this week saw the first-ever female chancellor make £40billion of sweeping tax rises to plug funding gaps, everywhere from the NHS and schools. While it left many of us with something to be miserable about when it comes to our money, there were also some important dodged bullets, as Simon Lambert,[...]

Whether you voted Labour or not, with any new government, there is a sense of optimism. Things can only get better… apparently. But within days, Rachel Reeves and co poured cold water over all that - and the gloom and doom about the economy and what then could be (and crucially not be) in the[...]

Whether you voted Labour or not, with any new government, there is a sense of optimism. Things can only get better… apparently. But within days, Rachel Reeves and co poured cold water over all that - and the gloom and doom about the economy and what then could be (and crucially not be) in the[...]

How well do you manage your money? Where would you rate your budgeting, saving, investing and pension efforts out of ten? It's not often that we think about these things but mulling them over and making improvements where needed and patting yourself on the back when deserved, is a major step on the road to[...]

How well do you manage your money? Where would you rate your budgeting, saving, investing and pension efforts out of ten? It's not often that we think about these things but mulling them over and making improvements where needed and patting yourself on the back when deserved, is a major step on the road to[...] The This is Money podcast recently welcomed Sir Steve Webb for a special episode where he answered listeners' questions on everything you need to know about pensions. In this excerpt, Steve and Simon Lambert discuss whether you should invest in a work pension or Sipp - and how to make the most of them. >[...]

The This is Money podcast recently welcomed Sir Steve Webb for a special episode where he answered listeners' questions on everything you need to know about pensions. In this excerpt, Steve and Simon Lambert discuss whether you should invest in a work pension or Sipp - and how to make the most of them. >[...]

Sir Steve Webb has been This is Money's pensions agony uncle for the past eight years - and this week he celebrated an astonishing 400 columns. Every week, Steve, in partnership with This is Money's pensions and investing editor Tanya Jefferies, answers readers' questions about retirement. On this special episode of the This is Money[...]

Sir Steve Webb has been This is Money's pensions agony uncle for the past eight years - and this week he celebrated an astonishing 400 columns. Every week, Steve, in partnership with This is Money's pensions and investing editor Tanya Jefferies, answers readers' questions about retirement. On this special episode of the This is Money[...] Do you keep savings in your current account? It’s an easy trap to fall into, with a third of people admitting they do it in a recent poll. If you do keep a savings pot in a bank account you are likely to be missing out on a big chunk of interest you could otherwise[...]

Do you keep savings in your current account? It’s an easy trap to fall into, with a third of people admitting they do it in a recent poll. If you do keep a savings pot in a bank account you are likely to be missing out on a big chunk of interest you could otherwise[...] Inheritance tax- punches above it s weight. It is paid by only a small minority of estates, yet manages to be Britain's most hated tax and its most controversial. Some believe it's immoral double taxation and should be axed altogether, others say crank it up - and somewhere in the middle there are many people[...]

Inheritance tax- punches above it s weight. It is paid by only a small minority of estates, yet manages to be Britain's most hated tax and its most controversial. Some believe it's immoral double taxation and should be axed altogether, others say crank it up - and somewhere in the middle there are many people[...] A bad news Budget looks to be on the cards after Labour continued to pour cold water on optimism its own election victory this week. Prime Minister Keir Starmer delivered a gloomy speech saying the Budget was going to be painful, hot on the heels of Chancellor Rachel Reeves' own gloom-mongering. But having made a[...]

A bad news Budget looks to be on the cards after Labour continued to pour cold water on optimism its own election victory this week. Prime Minister Keir Starmer delivered a gloomy speech saying the Budget was going to be painful, hot on the heels of Chancellor Rachel Reeves' own gloom-mongering. But having made a[...] Gold has hit record highs this week and has rocketed so far this year. What’s driving the price and how do you invest? This week, Tanya Jefferies, Georgie Frost and Lee Boyce turn their attention to the precious metal – a notoriously volatile investment, but yet seen as a safe haven. Energy bills will be[...]

Gold has hit record highs this week and has rocketed so far this year. What’s driving the price and how do you invest? This week, Tanya Jefferies, Georgie Frost and Lee Boyce turn their attention to the precious metal – a notoriously volatile investment, but yet seen as a safe haven. Energy bills will be[...] This week, the consumer prices index measure of inflation nudged higher to 2.2 per cent. But what does this mean for future base rate decisions - and then in turn, mortgage rates and savings rates. This week, Lee Boyce and Georgie Frost discuss the latest inflation figures and what the rest of the year has[...]

This week, the consumer prices index measure of inflation nudged higher to 2.2 per cent. But what does this mean for future base rate decisions - and then in turn, mortgage rates and savings rates. This week, Lee Boyce and Georgie Frost discuss the latest inflation figures and what the rest of the year has[...] Stock markets around the world saw huge falls this week, but is it a sign of more trouble ahead or just a storm in a teacup? Simon takes a look at what’s behind it all, and why investors should avoid the temptation to start tinkering with their portfolios once the horse has already bolted. His[...]

Stock markets around the world saw huge falls this week, but is it a sign of more trouble ahead or just a storm in a teacup? Simon takes a look at what’s behind it all, and why investors should avoid the temptation to start tinkering with their portfolios once the horse has already bolted. His[...]

Building up a savings pot and then investing to growing your wealth and provide a decent pension for retirement is the key to long-term financial success. But there's lots to consider at each step - and most people will want to buy a home along the way. So what do you need to think about[...]

Building up a savings pot and then investing to growing your wealth and provide a decent pension for retirement is the key to long-term financial success. But there's lots to consider at each step - and most people will want to buy a home along the way. So what do you need to think about[...] It's official - we're complaining about our neighbours more, new data shows. When it comes to noise, many appear sick of barking dogs, squeaky trampolines and loud music ruining the enjoyment of our homes. This week, Simon Lambert, Lee Boyce and Georgie Frost talk about neighbour wars - and what we can do about it.[...]

It's official - we're complaining about our neighbours more, new data shows. When it comes to noise, many appear sick of barking dogs, squeaky trampolines and loud music ruining the enjoyment of our homes. This week, Simon Lambert, Lee Boyce and Georgie Frost talk about neighbour wars - and what we can do about it.[...] Do you feel financially confident? When it comes to budgeting, saving, investing, and building your pension, are you clueless, comfortable, or cracking on? A piece of research this week by Moneybox claimed that being financially confident could add £67,000 to your lifetime wealth – on average those with confidence were worth £145,000 on average, compared[...]

Do you feel financially confident? When it comes to budgeting, saving, investing, and building your pension, are you clueless, comfortable, or cracking on? A piece of research this week by Moneybox claimed that being financially confident could add £67,000 to your lifetime wealth – on average those with confidence were worth £145,000 on average, compared[...] All change, please. In a radical reshaping of the political landscape, Britain has elected a Labour government for the first time in 14 years. New prime minister Keir Starmer and Chancellor Rachel Reeves have made bold promises of revival, growth and wealth creation. But many fear that Britain’s troubled public finances will also mean that[...]

All change, please. In a radical reshaping of the political landscape, Britain has elected a Labour government for the first time in 14 years. New prime minister Keir Starmer and Chancellor Rachel Reeves have made bold promises of revival, growth and wealth creation. But many fear that Britain’s troubled public finances will also mean that[...] You find a decent paying savings account, diligently squirrel away your money, watch it grow… only for the taxman to come along and swipe a chunk. And since savings rates have been much better in recent years, the amount HMRC is taking in in savings tax revenue has gone up significantly It's only going to[...]

You find a decent paying savings account, diligently squirrel away your money, watch it grow… only for the taxman to come along and swipe a chunk. And since savings rates have been much better in recent years, the amount HMRC is taking in in savings tax revenue has gone up significantly It's only going to[...] Inflation is back on target at 2 per cent. After the spike into double-digits that triggered talk of a cost of living crisis and sent interest rates spiralling, we are now back at the Bank of England's target level. So, is the great inflation panic over and is life about get easier? Or will we[...]

Inflation is back on target at 2 per cent. After the spike into double-digits that triggered talk of a cost of living crisis and sent interest rates spiralling, we are now back at the Bank of England's target level. So, is the great inflation panic over and is life about get easier? Or will we[...] It’s manifesto week and Labour, the Conservatives and the Lib Dems have laid out their vision for the country – along with the Green Party, Reform and others. The economy, tax and people’s finances are a cornerstone of the all the manifestos, but what are the main parties proposing and what could it mean for[...]

It’s manifesto week and Labour, the Conservatives and the Lib Dems have laid out their vision for the country – along with the Green Party, Reform and others. The economy, tax and people’s finances are a cornerstone of the all the manifestos, but what are the main parties proposing and what could it mean for[...] How much do you need in Premium Bonds to win the jackpot? And if you haven’t maxed them out to the full £50,000, is it even worth bothering? This is Money has run some in-depth analysis on all the £1million prizes over the past four years and this week revealed how much those lucky people[...]

How much do you need in Premium Bonds to win the jackpot? And if you haven’t maxed them out to the full £50,000, is it even worth bothering? This is Money has run some in-depth analysis on all the £1million prizes over the past four years and this week revealed how much those lucky people[...] This is Money's consumer champion Helen Crane celebrated the 100th edition of her Crane on the Case column this week. Helen has won back more than £1.2million for readers over the course of all those columns and learnt a thing or two along the way about how to battle consumer problems and bad customer service.[...]

This is Money's consumer champion Helen Crane celebrated the 100th edition of her Crane on the Case column this week. Helen has won back more than £1.2million for readers over the course of all those columns and learnt a thing or two along the way about how to battle consumer problems and bad customer service.[...] The Prime Minister put an end to all the speculation this week by giving us the date for the general election: July 4. That comes as the latest inflation reading was 2.3 per cent, a little above forecasts making a base rate cut next month now unlikely. Simon Lambert, Georgie Frost and Lee Boyce delve[...]

The Prime Minister put an end to all the speculation this week by giving us the date for the general election: July 4. That comes as the latest inflation reading was 2.3 per cent, a little above forecasts making a base rate cut next month now unlikely. Simon Lambert, Georgie Frost and Lee Boyce delve[...] Supermarket loyalty schemes have become even more of a big thing in recent years as the two giants Tesco and Sainsbury's have rolled out Clubcard and Nectar Prices. But while cards bring lower prices, the points collected still mean prizes for some loyalty scheme fans. So, what happens if a fraudster steals your points? This[...]

Supermarket loyalty schemes have become even more of a big thing in recent years as the two giants Tesco and Sainsbury's have rolled out Clubcard and Nectar Prices. But while cards bring lower prices, the points collected still mean prizes for some loyalty scheme fans. So, what happens if a fraudster steals your points? This[...] The Bank of England decided to hold the base rate for the sixth time in a row this week – but was it the right decision? Should the MPC have been bold and made a cut? What does it mean for our mortgages and savings? And when will a move come - and in what[...]

The Bank of England decided to hold the base rate for the sixth time in a row this week – but was it the right decision? Should the MPC have been bold and made a cut? What does it mean for our mortgages and savings? And when will a move come - and in what[...] With not one but two mortgage spikes fresh in our minds, a flurry of rate rises have got home owners and potential buyers worried again. A bunch of major mortgage lenders raised their rates this week - and Santander did it twice. So, are we about to see another mortgage spike or is this just[...]

With not one but two mortgage spikes fresh in our minds, a flurry of rate rises have got home owners and potential buyers worried again. A bunch of major mortgage lenders raised their rates this week - and Santander did it twice. So, are we about to see another mortgage spike or is this just[...] You can wait a long time for a FTSE 100 record high but for peak-starved British investors this week delivered a bonanza. Four record highs were racked up by the FTSE 100, with only Wednesday's slight dip spoiling what would have been a perfect run over a week. The return to new highs on Thursday[...]

You can wait a long time for a FTSE 100 record high but for peak-starved British investors this week delivered a bonanza. Four record highs were racked up by the FTSE 100, with only Wednesday's slight dip spoiling what would have been a perfect run over a week. The return to new highs on Thursday[...]

Older people received another boost to the state pension this week taking the full rate to over £11,000 a year. This year's increase of 8.5 per cent was thanks to the triple lock commitment - a guarantee the state pension will rise each year by the higher of CPI, wages or 2.5 per cent. What[...]

Older people received another boost to the state pension this week taking the full rate to over £11,000 a year. This year's increase of 8.5 per cent was thanks to the triple lock commitment - a guarantee the state pension will rise each year by the higher of CPI, wages or 2.5 per cent. What[...] There's a warning for savers who's fixed term deals are coming to an end - don't take your eye off the ball now or risk having your returns wiped out in a matter of months. A year ago, there was a flurry of savers choosing fixed-rate bonds as they improved drastically. But if you don't[...]

There's a warning for savers who's fixed term deals are coming to an end - don't take your eye off the ball now or risk having your returns wiped out in a matter of months. A year ago, there was a flurry of savers choosing fixed-rate bonds as they improved drastically. But if you don't[...] The row over small deposit mortgage is the gift that keeps on giving. Hot on the heels of the Budget plan that never appeared arrives Yorkshire Building Society's new deal, that's been dubbed a 99 per cent mortgage. But is it really one of those and does it have any redeeming features? And if it's[...]

The row over small deposit mortgage is the gift that keeps on giving. Hot on the heels of the Budget plan that never appeared arrives Yorkshire Building Society's new deal, that's been dubbed a 99 per cent mortgage. But is it really one of those and does it have any redeeming features? And if it's[...] There is less than a fortnight to go before the end of the tax year and that means it's time to sort your Isa, pension and finances before it's too late. With another tax raid on the way for investors on capital gains and dividends, this is one of the most important tax year ends[...]

There is less than a fortnight to go before the end of the tax year and that means it's time to sort your Isa, pension and finances before it's too late. With another tax raid on the way for investors on capital gains and dividends, this is one of the most important tax year ends[...] The Bank of England held interest rates again this week as inflation dropped once more. So, are we out of the woods yet? Will inflation keep coming back down towards target and the Bank of England soon seamlessly switch back to cutting rates? Or will central bankers be keen to hold onto higher rates, even[...]

The Bank of England held interest rates again this week as inflation dropped once more. So, are we out of the woods yet? Will inflation keep coming back down towards target and the Bank of England soon seamlessly switch back to cutting rates? Or will central bankers be keen to hold onto higher rates, even[...]

Jeremy Hunt bounced around delivering his Budget on Wednesday, proudly declaring his commitment to tax cuts and supporting working families. Another 2p was chopped off National Insurance and the threshold at which child benefit is removed was raised from £50,000 to £60,000. But you don’t need to be a financial expert to know that the[...]

Jeremy Hunt bounced around delivering his Budget on Wednesday, proudly declaring his commitment to tax cuts and supporting working families. Another 2p was chopped off National Insurance and the threshold at which child benefit is removed was raised from £50,000 to £60,000. But you don’t need to be a financial expert to know that the[...] On this bonus episode of the This is Money Podcast, Simon Lambert is joined by Charles Stanley Direct’s Lisa Caplan and Garry White for a quick run through what was in the Budget. Investment experts Lisa and Garry talk us through the main Budget points and what they mean for people. Join us on Friday[...]

On this bonus episode of the This is Money Podcast, Simon Lambert is joined by Charles Stanley Direct’s Lisa Caplan and Garry White for a quick run through what was in the Budget. Investment experts Lisa and Garry talk us through the main Budget points and what they mean for people. Join us on Friday[...] The debacle over widespread errors in the state pension that This is Money and Sir Steve Webb uncovered, continues. As of the end of October last year, DWP had paid out just under half a billion pounds to more than 80,000 people who’ve been underpaid. But what about those who have died? This week, Tanya[...]

The debacle over widespread errors in the state pension that This is Money and Sir Steve Webb uncovered, continues. As of the end of October last year, DWP had paid out just under half a billion pounds to more than 80,000 people who’ve been underpaid. But what about those who have died? This week, Tanya[...] With the Budget tipped to be the Chancellor’s last roll of the dice before a General Election, expectations over tax cuts are growing. But what taxes could Jeremy Hunt choose to cut and why – and is there hope that he will sort out the tax mess that Britain has got stuck in. The higher[...]

With the Budget tipped to be the Chancellor’s last roll of the dice before a General Election, expectations over tax cuts are growing. But what taxes could Jeremy Hunt choose to cut and why – and is there hope that he will sort out the tax mess that Britain has got stuck in. The higher[...] It's finally happened. After months of will-we, won't-we speculation, the UK economy has finally succumbed to recession. The ONS revealed this week that a drop in GDP in the final three months of 2023 meant that Britain had racked up two consecutive of negative growth - and thus the dreaded R word is here. But[...]

It's finally happened. After months of will-we, won't-we speculation, the UK economy has finally succumbed to recession. The ONS revealed this week that a drop in GDP in the final three months of 2023 meant that Britain had racked up two consecutive of negative growth - and thus the dreaded R word is here. But[...] In this special bonus This is Money podcast episode, Simon Lambert speaks to easyJet founder Sir Stelios Haji-Ioannou. Sir Stelios tells the story of how he launched easyJet his easyGroup of companies - and how allowing others to build companies using the easy brand works. He also explains why he is backing entrepreneurs under the[...]

In this special bonus This is Money podcast episode, Simon Lambert speaks to easyJet founder Sir Stelios Haji-Ioannou. Sir Stelios tells the story of how he launched easyJet his easyGroup of companies - and how allowing others to build companies using the easy brand works. He also explains why he is backing entrepreneurs under the[...] The cost of a comfortable retirement has jumped over the past year - but what do you need to get one and will you get there? As the Pension and Lifetime Savings Association updates its annual look at how much income people need for a basic, moderate or comfortable retirement, Georgie Frost, Lee Boyce and[...]

The cost of a comfortable retirement has jumped over the past year - but what do you need to get one and will you get there? As the Pension and Lifetime Savings Association updates its annual look at how much income people need for a basic, moderate or comfortable retirement, Georgie Frost, Lee Boyce and[...] The Bank of England held base rate once again at 5.25 per cent, the fourth hold in succession – but this time, it was a genuine split by MPC members. So, when will we start seeing rates fall – and will inflation really be at the target 2 per cent by April? This week, Simon[...]

The Bank of England held base rate once again at 5.25 per cent, the fourth hold in succession – but this time, it was a genuine split by MPC members. So, when will we start seeing rates fall – and will inflation really be at the target 2 per cent by April? This week, Simon[...] Britain's disposable income has dropped substantially over the past 14 years compared to where it should be, according to a new report this week. The Centre for Cities said that the average household's disposable income has fallen £10,000 behind where it would have been if pre-2010 growth rates had been maintained. On average we have[...]

Britain's disposable income has dropped substantially over the past 14 years compared to where it should be, according to a new report this week. The Centre for Cities said that the average household's disposable income has fallen £10,000 behind where it would have been if pre-2010 growth rates had been maintained. On average we have[...] The Government wants us to get heat pumps fitted in our homes and it's offering up to £7,500 for us to do so. Now Worcester Bosch is bumping that up by an extra £2,500 - if you pick one of theirs of course. But with the devices cost between £8,000 to £30,000 to buy and[...]

The Government wants us to get heat pumps fitted in our homes and it's offering up to £7,500 for us to do so. Now Worcester Bosch is bumping that up by an extra £2,500 - if you pick one of theirs of course. But with the devices cost between £8,000 to £30,000 to buy and[...] After a good year for Premium Bonds when the only way was up for the prize fund rate, savers got a blow this week as a cut arrived. The prize fund rate is being cut to 4.4 per cent from 4.65 per cent. That edges the average return - which you may or may[...]

After a good year for Premium Bonds when the only way was up for the prize fund rate, savers got a blow this week as a cut arrived. The prize fund rate is being cut to 4.4 per cent from 4.65 per cent. That edges the average return - which you may or may[...] Have you ever sold anything on Ebay, Vinted or Facebook Marketplace to make a bit of extra cash? Those who do may have been worried this week, as news that the websites will now be required to report sellers' activities to the taxman caused panic online. So what are the rules - and is HMRC[...]

Have you ever sold anything on Ebay, Vinted or Facebook Marketplace to make a bit of extra cash? Those who do may have been worried this week, as news that the websites will now be required to report sellers' activities to the taxman caused panic online. So what are the rules - and is HMRC[...]

The Bank of England has reached the peak with interest rates in this cycle. That's the firm view of the markets and most analysts, despite three members of the nine-strong Monetary Policy Committee disagreeing and voting for a rate hike this week. The question has now shifted from how high will rates go, to when[...]

The Bank of England has reached the peak with interest rates in this cycle. That's the firm view of the markets and most analysts, despite three members of the nine-strong Monetary Policy Committee disagreeing and voting for a rate hike this week. The question has now shifted from how high will rates go, to when[...] It's been a rollercoaster year for mortgage rates and after the inflation panic spike over summer, lenders have been slashing costs for borrowers. The best mortgage rates are now falling towards 4 per cent, whereas not so many months ago they were rising towards 6 per cent - and many deals climbed above that. So[...]

It's been a rollercoaster year for mortgage rates and after the inflation panic spike over summer, lenders have been slashing costs for borrowers. The best mortgage rates are now falling towards 4 per cent, whereas not so many months ago they were rising towards 6 per cent - and many deals climbed above that. So[...] We love the idea of transforming our homes so much that an entire cottage TV industry has sprung out of it, ranging from Grand Designs, to Ugly House to Lovely House and Your Home Made Perfect. For Jaemi and Roly Glancy sketching out how they could renovate their properties turned into a start-up helping others[...]

We love the idea of transforming our homes so much that an entire cottage TV industry has sprung out of it, ranging from Grand Designs, to Ugly House to Lovely House and Your Home Made Perfect. For Jaemi and Roly Glancy sketching out how they could renovate their properties turned into a start-up helping others[...] What drives you mad about going to the supermarket? Is it self-service tills, scanning receipts to get out, loyalty scheme dual pricing, or prices being hiked well above inflation? Many of us want to support bricks and mortar retail, but there are times when shops seem to mainly be involved in testing our patience. In[...]

What drives you mad about going to the supermarket? Is it self-service tills, scanning receipts to get out, loyalty scheme dual pricing, or prices being hiked well above inflation? Many of us want to support bricks and mortar retail, but there are times when shops seem to mainly be involved in testing our patience. In[...] The Autumn Statement was the definition of a mixed bag. There was a National Insurance cut, but the stealth income tax raid continued. The Isa system got an improvement, but the allowance remained frozen. Meanwhile, the triple lock was delivered along with a pension pot-for-life plan but inheritance tax remains firmly uncut at 40 per[...]

The Autumn Statement was the definition of a mixed bag. There was a National Insurance cut, but the stealth income tax raid continued. The Isa system got an improvement, but the allowance remained frozen. Meanwhile, the triple lock was delivered along with a pension pot-for-life plan but inheritance tax remains firmly uncut at 40 per[...] The Autumn Statement arrives next week and the rumour mill has gone into overdrive. The idea of it being a simple update on the economy seems to have been abandoned and instead there is talk of an Isa overhaul, tax changes, and even inheritance tax being cut from 40 per cent to 20 per cent.[...]

The Autumn Statement arrives next week and the rumour mill has gone into overdrive. The idea of it being a simple update on the economy seems to have been abandoned and instead there is talk of an Isa overhaul, tax changes, and even inheritance tax being cut from 40 per cent to 20 per cent.[...] We all know pensions are important but most of us rarely engage with them. Yet, with a little bit of time and effort, you can get your work pension working as hard as possible for you - and at some point in the future you will be very glad you did so. On this episode[...]

We all know pensions are important but most of us rarely engage with them. Yet, with a little bit of time and effort, you can get your work pension working as hard as possible for you - and at some point in the future you will be very glad you did so. On this episode[...] Have interest rates peaked? After an inflation spike rudely awoke them from their slumbers, the Bank of England and the US Federal Reserve have shown us that rate hiking can be a difficult habit to break. But 14 consecutive rate rises into an astonishing run from 0.1 per cent to 5.25 per cent for the[...]

Have interest rates peaked? After an inflation spike rudely awoke them from their slumbers, the Bank of England and the US Federal Reserve have shown us that rate hiking can be a difficult habit to break. But 14 consecutive rate rises into an astonishing run from 0.1 per cent to 5.25 per cent for the[...] This week, This is Money's pensions expert Tanya Jefferies joins Simon Lambert and Georgie Frost. Among the topics being discussed: State pension top-ups are in dire need of an overhaul by DWP and HMRC, says TANYA JEFFERIES What does the bond market sell-off mean for your investments and pension? UK bond yields at 25 year[...]

This week, This is Money's pensions expert Tanya Jefferies joins Simon Lambert and Georgie Frost. Among the topics being discussed: State pension top-ups are in dire need of an overhaul by DWP and HMRC, says TANYA JEFFERIES What does the bond market sell-off mean for your investments and pension? UK bond yields at 25 year[...] Wages are up, but inflation is… the same. What does it all mean for mortgage rates, the state pension, benefits and the economy generally? One thing we know won’t be affected by the latest figure is income tax bands. Just how much is the big freeze – AKA fiscal drag - going to cost[...]

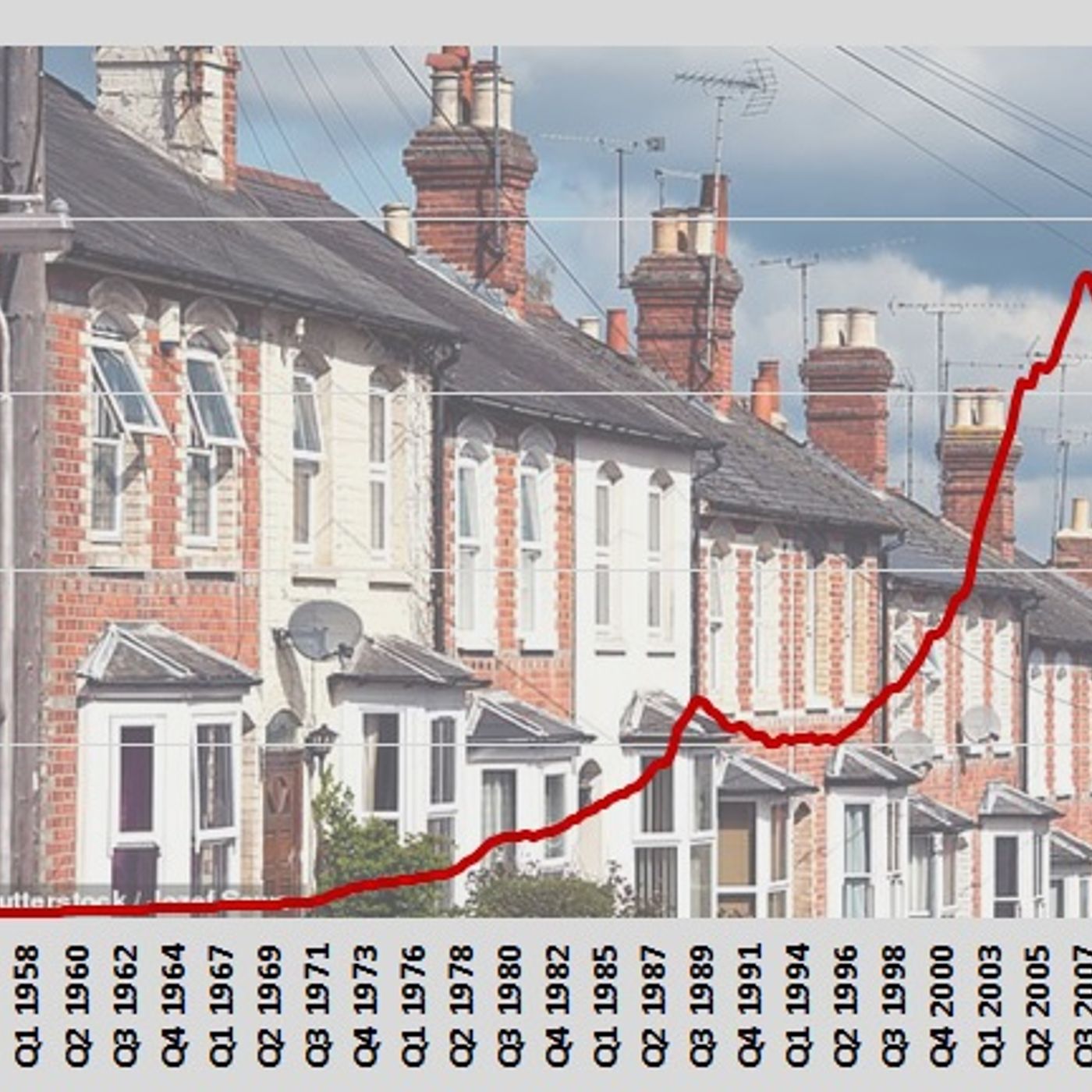

Wages are up, but inflation is… the same. What does it all mean for mortgage rates, the state pension, benefits and the economy generally? One thing we know won’t be affected by the latest figure is income tax bands. Just how much is the big freeze – AKA fiscal drag - going to cost[...] House prices will continue to fall, says an influential poll of estate agents. The latest survey by the Royal Institution of Chartered Surveyors found that buyer demand is declining and fewer homes are coming to the market. Meanwhile, Halifax’s latest house price figures show a £14,000 drop compared to the recent peak in August 2022[...]

House prices will continue to fall, says an influential poll of estate agents. The latest survey by the Royal Institution of Chartered Surveyors found that buyer demand is declining and fewer homes are coming to the market. Meanwhile, Halifax’s latest house price figures show a £14,000 drop compared to the recent peak in August 2022[...] Inflation is easing, food prices are coming down from their peak and the energy price cap dropped last weekend. But you are still paying around 10 per cent more for your groceries now than last year, petrol prices are rising, mortgage rates are still high, and you may end up paying more for your gas[...]

Inflation is easing, food prices are coming down from their peak and the energy price cap dropped last weekend. But you are still paying around 10 per cent more for your groceries now than last year, petrol prices are rising, mortgage rates are still high, and you may end up paying more for your gas[...] It’s been called the most hated tax in Britain - but only four per cent of people pay it. You could be forgiven for thinking inheritance tax is something only the super-rich need to worry about. But thanks to rising house prices and an increasing desire to transfer wealth between generations, more and more people[...]

It’s been called the most hated tax in Britain - but only four per cent of people pay it. You could be forgiven for thinking inheritance tax is something only the super-rich need to worry about. But thanks to rising house prices and an increasing desire to transfer wealth between generations, more and more people[...] And suddenly they stopped. After 14 interest rate rises in a row, the Bank of England stalled and kept base rate on hold. A lower than expected inflation number and slew of economic reports indicating the heat was being taken out of the economy were credited with staying the Monetary Policy Committee's hand. So, will[...]

And suddenly they stopped. After 14 interest rate rises in a row, the Bank of England stalled and kept base rate on hold. A lower than expected inflation number and slew of economic reports indicating the heat was being taken out of the economy were credited with staying the Monetary Policy Committee's hand. So, will[...] This is Money's Simon Lambert gives his tips for young pension savers on how to give their retirement fund a big boost - and in some instances double the pot they end up with.

This is Money's Simon Lambert gives his tips for young pension savers on how to give their retirement fund a big boost - and in some instances double the pot they end up with. If the triple lock is stuck to, the state pension should rise by 8.5 per cent next April. That will be an inflation-busting rise but a promise is a promise - and the triple lock is meant to be a cast iron guarantee that the state pension will rise by either 2.5 per cent, average[...]

If the triple lock is stuck to, the state pension should rise by 8.5 per cent next April. That will be an inflation-busting rise but a promise is a promise - and the triple lock is meant to be a cast iron guarantee that the state pension will rise by either 2.5 per cent, average[...] Every child could receive a pot of £1,000 at birth to be channelled into long-term investments in UK growth under proposals to give the young a leg up and revive a ‘stagnant’ economy. The idea of a ‘New Generation Trust’ is part of a package of reforms that could add £225billion to the economy, says[...]

Every child could receive a pot of £1,000 at birth to be channelled into long-term investments in UK growth under proposals to give the young a leg up and revive a ‘stagnant’ economy. The idea of a ‘New Generation Trust’ is part of a package of reforms that could add £225billion to the economy, says[...] Inflation has been ravaging our finances, but it is also threatening our future. According to new research, if you want a comfortable retirement, you need to build a pot of nearly £600,000. The rising cost of living requires an extra £4,200 a year to maintain the same lifestyle as in spring last year - which[...]

Inflation has been ravaging our finances, but it is also threatening our future. According to new research, if you want a comfortable retirement, you need to build a pot of nearly £600,000. The rising cost of living requires an extra £4,200 a year to maintain the same lifestyle as in spring last year - which[...] Many people may be feeling in a state of financial flux at the moment and wondering where to put their money. And it's not an easy choice. Savings rates have improved, gold is holding steady, but property prices are slipping and stocks are sticky. And that is just some of the myriad of options Britons[...]

Many people may be feeling in a state of financial flux at the moment and wondering where to put their money. And it's not an easy choice. Savings rates have improved, gold is holding steady, but property prices are slipping and stocks are sticky. And that is just some of the myriad of options Britons[...] The inflation spike took central banks, governments and many ordinary people by surprise but Britain’s cost of living problem has proved more stubborn that most. The latest set of official figures on consumer prices index inflation seem to show that the UK may be making some headway on getting it down. Aided by a substantial[...]

The inflation spike took central banks, governments and many ordinary people by surprise but Britain’s cost of living problem has proved more stubborn that most. The latest set of official figures on consumer prices index inflation seem to show that the UK may be making some headway on getting it down. Aided by a substantial[...] After months of mortgage mayhem some better news finally arrived this week with major lenders delivering a slew of hefty rate cuts. Halifax, Nationwide, and NatWest have all delivered big chops to their home loans, with analysts saying that we may be past the moment of peak panic in the mortgage market. That’s the silver[...]

After months of mortgage mayhem some better news finally arrived this week with major lenders delivering a slew of hefty rate cuts. Halifax, Nationwide, and NatWest have all delivered big chops to their home loans, with analysts saying that we may be past the moment of peak panic in the mortgage market. That’s the silver[...] When it comes to HM Revenue & Customs, it's safe to say that many business owners and accountants have become well-acquainted with chaos. The push for a digital tax system has left some waiting months to receive basic tax information - and following a This is Money investigation, where we spoke to someone inside the[...]

When it comes to HM Revenue & Customs, it's safe to say that many business owners and accountants have become well-acquainted with chaos. The push for a digital tax system has left some waiting months to receive basic tax information - and following a This is Money investigation, where we spoke to someone inside the[...] Energy firms have had their feet held to the fire this week. The industry as a whole has been blasted by the regulator Ofgem over poor customer service, while our investigation revealed that 200 customers don't think Ovo has been billing them properly. Meanwhile, British Gas has been in the spotlight for its bumper profits,[...]

Energy firms have had their feet held to the fire this week. The industry as a whole has been blasted by the regulator Ofgem over poor customer service, while our investigation revealed that 200 customers don't think Ovo has been billing them properly. Meanwhile, British Gas has been in the spotlight for its bumper profits,[...] Earlier in the week, the consumer prices index measure of inflation fell by more than expected thanks to a fall in transport and food prices. It eased to 7.9 per cent in June, a bigger drop than expected, according to the Office for National Statistics. This was the lowest CPI rate since March 2022 when[...]

Earlier in the week, the consumer prices index measure of inflation fell by more than expected thanks to a fall in transport and food prices. It eased to 7.9 per cent in June, a bigger drop than expected, according to the Office for National Statistics. This was the lowest CPI rate since March 2022 when[...]

Banks have come into the firing line this week over current account closures and slowness to pass on base rate rises to savers. Nigel Farage claims his bank shut his current account over his Brexit views – the former politician has been vocal on Twitter about his treatment by Coutts, while the exclusive bank with[...]

Banks have come into the firing line this week over current account closures and slowness to pass on base rate rises to savers. Nigel Farage claims his bank shut his current account over his Brexit views – the former politician has been vocal on Twitter about his treatment by Coutts, while the exclusive bank with[...] Artificial intelligence has burst into the headlines over the past year and generated excitement among investors. But as with any exciting new technology that has generated a lot of hype, there will be pitfalls for investors along the way. If you want to invest in the AI revolution, what other companies could benefit and what[...]

Artificial intelligence has burst into the headlines over the past year and generated excitement among investors. But as with any exciting new technology that has generated a lot of hype, there will be pitfalls for investors along the way. If you want to invest in the AI revolution, what other companies could benefit and what[...] There has been plenty of doom and gloom in recent months – and today, we go searching for cheerier news. The energy price cap will fall from the weekend, plunging to £2,074 – below the £2,500 set Energy Price Guarantee from the Government. So, what should you be doing to prepare – and what does[...]

There has been plenty of doom and gloom in recent months – and today, we go searching for cheerier news. The energy price cap will fall from the weekend, plunging to £2,074 – below the £2,500 set Energy Price Guarantee from the Government. So, what should you be doing to prepare – and what does[...] The Bank of England’s bumper 0.5 per cent rate hike this week was the 13th rise in a row. After sitting on their hands for more than a decade, ratesetters have been shaken out of their slumbers by an inflation storm. By historic standards 5 per cent is not high for interest rates, but unfortunately[...]

The Bank of England’s bumper 0.5 per cent rate hike this week was the 13th rise in a row. After sitting on their hands for more than a decade, ratesetters have been shaken out of their slumbers by an inflation storm. By historic standards 5 per cent is not high for interest rates, but unfortunately[...] The mortgage market is mayhem, with lenders pulling deals and rapidly hiking rates. Average fixed mortgage rates have soared over the past month and we are now at the stage where it looks a lot like the panic after the mini-Budget. At the same time savings rates are going gangbusters and there is barely a[...]

The mortgage market is mayhem, with lenders pulling deals and rapidly hiking rates. Average fixed mortgage rates have soared over the past month and we are now at the stage where it looks a lot like the panic after the mini-Budget. At the same time savings rates are going gangbusters and there is barely a[...] Universal basic income is a controversial idea and not just because it's money for nothing. Paying everyone a set amount every month as a baseline level of income has intrigued economists and central bank geeks for years. Supporters say it has the power to improve physical and mental health and the economy and society, but[...]

Universal basic income is a controversial idea and not just because it's money for nothing. Paying everyone a set amount every month as a baseline level of income has intrigued economists and central bank geeks for years. Supporters say it has the power to improve physical and mental health and the economy and society, but[...] Forget 5 per cent savings rates. Forget 7 per cent. A new regular savings deal has landed paying a headline-grabbing 9 per cent. But, is it actually a good deal? Saffron Building Society aren't the only savings provider pumping up rates, with fixed-rates now hitting 5.25 per cent. And cash Isas are back with a[...]

Forget 5 per cent savings rates. Forget 7 per cent. A new regular savings deal has landed paying a headline-grabbing 9 per cent. But, is it actually a good deal? Saffron Building Society aren't the only savings provider pumping up rates, with fixed-rates now hitting 5.25 per cent. And cash Isas are back with a[...] We had some good news this week about our energy bills - or did we? Ofgem's price cap is coming down - saving households around £400 a year on average. The last 18 months have been horrendous for households, so bad the Government had to step in in October and introduce a price freeze -[...]

We had some good news this week about our energy bills - or did we? Ofgem's price cap is coming down - saving households around £400 a year on average. The last 18 months have been horrendous for households, so bad the Government had to step in in October and introduce a price freeze -[...] Almost five times as many people will soon be paying 40 per cent tax than in the early 1990s, when it was seen as a tax bracket reserved for the rich, the Institute for Fiscal Studies warned this week. It said that fiscal drag triggered by freezing the higher rate tax threshold would pull 7.8million[...]

Almost five times as many people will soon be paying 40 per cent tax than in the early 1990s, when it was seen as a tax bracket reserved for the rich, the Institute for Fiscal Studies warned this week. It said that fiscal drag triggered by freezing the higher rate tax threshold would pull 7.8million[...] And there it was, another interest rate hike. Another quarter point move up seems almost commonplace now but cast your mind back to the era after the financial crisis and we had to wait nearly ten years for the base rate to climb above its 0.5 per cent 'emergency level'. It cut got first and[...]

And there it was, another interest rate hike. Another quarter point move up seems almost commonplace now but cast your mind back to the era after the financial crisis and we had to wait nearly ten years for the base rate to climb above its 0.5 per cent 'emergency level'. It cut got first and[...] A row over housebuilding has erupted again. Labour leader Keir Starmer has said he would bring back a 300,000 annual housebuilding target, after Rishi Sunak scrapped it. Meanwhile, some backbench Tory MPs are reportedly unhappy about their party ditching that target in the first place – with the number having featured in the 2019 Conservative[...]

A row over housebuilding has erupted again. Labour leader Keir Starmer has said he would bring back a 300,000 annual housebuilding target, after Rishi Sunak scrapped it. Meanwhile, some backbench Tory MPs are reportedly unhappy about their party ditching that target in the first place – with the number having featured in the 2019 Conservative[...]

Premium Bonds are a national institution and their prize-giving place in British savers' hearts was only cemented further through the low interest rate years. But now interest rates are on the rise and Premium Bonds offer not only the chance to win £1million but also a much better rate of return. The average prize fund[...]

Premium Bonds are a national institution and their prize-giving place in British savers' hearts was only cemented further through the low interest rate years. But now interest rates are on the rise and Premium Bonds offer not only the chance to win £1million but also a much better rate of return. The average prize fund[...] As if buying a home wasn’t enough of a lottery, borrowers are now facing a major gamble on their mortgage. Whether buying or remortgaging, they need to work out how long to fix for and try to assess what might happen next to interest rates. On the basis that even the world’s top economists and[...]

As if buying a home wasn’t enough of a lottery, borrowers are now facing a major gamble on their mortgage. Whether buying or remortgaging, they need to work out how long to fix for and try to assess what might happen next to interest rates. On the basis that even the world’s top economists and[...] The state pension is getting a boost this week, meaning many pensioners will see their payments go above £200 per week or £10,000 per year for the first time. The Government has also recently announced that it is delaying a decision on hiking up the state pension age to 68 until after the next election[...]

The state pension is getting a boost this week, meaning many pensioners will see their payments go above £200 per week or £10,000 per year for the first time. The Government has also recently announced that it is delaying a decision on hiking up the state pension age to 68 until after the next election[...] Just when you thought the cost of living crisis was meant to be on its way out another round of bill hikes are hitting. From council tax to mobile bills, seemingly every organisation wants another piece of your bank account - and some of the rises are even higher than inflation. Is there anything you[...]

Just when you thought the cost of living crisis was meant to be on its way out another round of bill hikes are hitting. From council tax to mobile bills, seemingly every organisation wants another piece of your bank account - and some of the rises are even higher than inflation. Is there anything you[...] Just when you thought it was safe to go back in the water... A banking crisis has seemingly emerged out of nowhere, in a system that we've been told is stable, well capitalised and far from its parlous state when the credit crunch and financial crisis struck. So, what is going on and why did[...]

Just when you thought it was safe to go back in the water... A banking crisis has seemingly emerged out of nowhere, in a system that we've been told is stable, well capitalised and far from its parlous state when the credit crunch and financial crisis struck. So, what is going on and why did[...] Jeremy Hunt had a spring in his step this week as he delivered his Budget. It was a considerably different air to the gloomy warning of trouble ahead in his November Autumn Statement. The headline act was a major shake-up of pension saving rules, removing restrictions that limit the amount that can go in without[...]

Jeremy Hunt had a spring in his step this week as he delivered his Budget. It was a considerably different air to the gloomy warning of trouble ahead in his November Autumn Statement. The headline act was a major shake-up of pension saving rules, removing restrictions that limit the amount that can go in without[...] You'd like to imagine that when it came to the state pension, you'd be dealing with a more robust system than the ones that deliver the average customer service nightmare. Savers could be forgive for questioning whether that was the case after a string of recent blunders. First we had the underpaid women's state pensions[...]

You'd like to imagine that when it came to the state pension, you'd be dealing with a more robust system than the ones that deliver the average customer service nightmare. Savers could be forgive for questioning whether that was the case after a string of recent blunders. First we had the underpaid women's state pensions[...]

There's not long left until the end of the tax year - and that means it is time to sort your Isa if you haven't already. This year's Isa allowance runs out as the tax year ticks over on 6 April and it pays to get everything you can into the tax-free shelter for savings[...]

There's not long left until the end of the tax year - and that means it is time to sort your Isa if you haven't already. This year's Isa allowance runs out as the tax year ticks over on 6 April and it pays to get everything you can into the tax-free shelter for savings[...] Where there's a will, there's often a grumble... and potentially a full on dispute. The amount of money involved in inheritances derived from even modest homes these days can be life changing and when someone feels they have been unfairly cut out or not given their dues, arguments can ensue. There's been a sharp rise[...]

Where there's a will, there's often a grumble... and potentially a full on dispute. The amount of money involved in inheritances derived from even modest homes these days can be life changing and when someone feels they have been unfairly cut out or not given their dues, arguments can ensue. There's been a sharp rise[...] Inflation is theoretically running out of steam but there's one essential that's still going up in price rapidly: food. Even as energy prices and other recent highly inflationary items slow a bit, the cost of food seems to show no let up - with reports reporting inflation-busting rises. What is going on here? How much[...]

Inflation is theoretically running out of steam but there's one essential that's still going up in price rapidly: food. Even as energy prices and other recent highly inflationary items slow a bit, the cost of food seems to show no let up - with reports reporting inflation-busting rises. What is going on here? How much[...] Are we nearly there yet? The Bank of England hiked interest rates again this week, adding 0.5 per cent to take base rate to 4 per cent. That’s a level that it was almost unthinkable we’d reach so quickly a year ago, but rates have gone up hard and fast. The questions now are will[...]

Are we nearly there yet? The Bank of England hiked interest rates again this week, adding 0.5 per cent to take base rate to 4 per cent. That’s a level that it was almost unthinkable we’d reach so quickly a year ago, but rates have gone up hard and fast. The questions now are will[...] Those aged between 43 and 54 may have been concerned by rumours this week that the Government is planning to increase the state pension age to 68 much sooner than planned. Officially, the rise to 68 is set to happen between 2044 and 2046, but ministers allegedly want to bring forward the change to 2035[...]

Those aged between 43 and 54 may have been concerned by rumours this week that the Government is planning to increase the state pension age to 68 much sooner than planned. Officially, the rise to 68 is set to happen between 2044 and 2046, but ministers allegedly want to bring forward the change to 2035[...] An astonishing idea for an Isa tax raid was outlined by the Resolution Foundation this week, with the proposal that tax-free savings and investments should be capped at £100,000. No more aspiring to be an Isa millionaire, it would be £100k and out under this plan. It said that the nominal money out toward not[...]

An astonishing idea for an Isa tax raid was outlined by the Resolution Foundation this week, with the proposal that tax-free savings and investments should be capped at £100,000. No more aspiring to be an Isa millionaire, it would be £100k and out under this plan. It said that the nominal money out toward not[...] What do you picture in retirement? Is it an early exit from the rat race to travel the world, a gradual step back and a bit of golf, or working until state pension age and then spending some time treating the grandchildren? We will all have a different image in our heads of what our[...]

What do you picture in retirement? Is it an early exit from the rat race to travel the world, a gradual step back and a bit of golf, or working until state pension age and then spending some time treating the grandchildren? We will all have a different image in our heads of what our[...] The New Year has arrived and with it promises of inflation falling and a ray of hope on energy bills. But even if Rishi Sunak halves inflation, as he claims he will, it would still be running at 5 per cent and his promise to get Britain back to growth may prove harder than the[...]

The New Year has arrived and with it promises of inflation falling and a ray of hope on energy bills. But even if Rishi Sunak halves inflation, as he claims he will, it would still be running at 5 per cent and his promise to get Britain back to growth may prove harder than the[...] Tumultous is a word that doesn't really do 2022 justice. Most people were looking forward to a year of calm as the Covid pandemic faded, but instead got turmoil and the cost of living crisis. In the UK, we mixed the global unrest dealt by Russia's invasion of Ukraine and the inflation spike, with our[...]

Tumultous is a word that doesn't really do 2022 justice. Most people were looking forward to a year of calm as the Covid pandemic faded, but instead got turmoil and the cost of living crisis. In the UK, we mixed the global unrest dealt by Russia's invasion of Ukraine and the inflation spike, with our[...] First we had the great resignation and now we may be seeing a new trend emerge 'unretirement'. Amid the turmoil of the pandemic, Britain's economy threw up the puzzle of a dramatic rise in economic inactivity - as about 565,000 people dropped out of the workforce to a position where they were neither working or[...]

First we had the great resignation and now we may be seeing a new trend emerge 'unretirement'. Amid the turmoil of the pandemic, Britain's economy threw up the puzzle of a dramatic rise in economic inactivity - as about 565,000 people dropped out of the workforce to a position where they were neither working or[...] The Bank of England has hiked base rate from 0.1 per cent to 3.5 per cent in the space of 12 months, a move that would have been considered unthinkable not so long ago. But with inflation looking as if it has peaked, the economy probably already in recession, households and businesses feeling the squeeze,[...]

The Bank of England has hiked base rate from 0.1 per cent to 3.5 per cent in the space of 12 months, a move that would have been considered unthinkable not so long ago. But with inflation looking as if it has peaked, the economy probably already in recession, households and businesses feeling the squeeze,[...] The mortgage crunch has stalled the pandemic property boom and sent house prices down, but could they fall 20 per cent? The risk of a severe house price downturn of that magnitude was flagged by Rightmove founder and property market veteran Harry Hill. Hill’s CV includes setting up property giant Rightmove and selling estate agency[...]

The mortgage crunch has stalled the pandemic property boom and sent house prices down, but could they fall 20 per cent? The risk of a severe house price downturn of that magnitude was flagged by Rightmove founder and property market veteran Harry Hill. Hill’s CV includes setting up property giant Rightmove and selling estate agency[...] Many people have not had to worry about paying tax on their savings and investments for some time. The advent of the £1,000 personal savings allowance combined with savings rates near record lows meant basic rate taxpayers would need big cash pots to incur 20 per cent tax on their interest. Meanwhile, even higher rate[...]

Many people have not had to worry about paying tax on their savings and investments for some time. The advent of the £1,000 personal savings allowance combined with savings rates near record lows meant basic rate taxpayers would need big cash pots to incur 20 per cent tax on their interest. Meanwhile, even higher rate[...] Savings and mortgage rates rocketed after what must now always be known as the 'ill-fated mini-Budget', but even as the Bank of England continues to raise rates have they already peaked. The top fixed rate savings deals have edged down from their highest levels - a five-year fix can no longer be had above 5[...]

Savings and mortgage rates rocketed after what must now always be known as the 'ill-fated mini-Budget', but even as the Bank of England continues to raise rates have they already peaked. The top fixed rate savings deals have edged down from their highest levels - a five-year fix can no longer be had above 5[...] ‘Jeremy Hunt’s mini-Budget was like the tax part of the Corbyn manifesto with none of the benefits of the extra spending.’ That was This is Money editor Simon Lambert’s verdict on the Chancellor’s tax-hiking spree that painted a miserable picture of the years ahead, hit higher earners, and hammered small investors. In a blizzard of[...]

‘Jeremy Hunt’s mini-Budget was like the tax part of the Corbyn manifesto with none of the benefits of the extra spending.’ That was This is Money editor Simon Lambert’s verdict on the Chancellor’s tax-hiking spree that painted a miserable picture of the years ahead, hit higher earners, and hammered small investors. In a blizzard of[...] ‘If they could tax the air you breathe they’d do it.’ That age-old moan about taxes going up has sprung to mind over the past week, as rumours about pretty much any tax you can think of being hiked were spread about. So many kites were flown about potential tax rises that even taxing selling[...]

‘If they could tax the air you breathe they’d do it.’ That age-old moan about taxes going up has sprung to mind over the past week, as rumours about pretty much any tax you can think of being hiked were spread about. So many kites were flown about potential tax rises that even taxing selling[...]

The tense situation between tenants and landlords is escalating: the former have seen rents spiral but the latter have faced a big jump in costs jump too. Meanwhile regulation has become a bugbear between the two sides, is there not enough of it or too much? What can be done to improve things in the[...]

The tense situation between tenants and landlords is escalating: the former have seen rents spiral but the latter have faced a big jump in costs jump too. Meanwhile regulation has become a bugbear between the two sides, is there not enough of it or too much? What can be done to improve things in the[...] There's a new Chancellor in town and he means business. Serious business. After Kwasi Kwarteng tried to spread some joy to get growth going with tax cuts for all, Jeremy Hunt and the fun police have stepped in to stop the markets freaking out. The fallout from Kwarteng's ill-fated mini-budget has now claimed his Chancellorship[...]

There's a new Chancellor in town and he means business. Serious business. After Kwasi Kwarteng tried to spread some joy to get growth going with tax cuts for all, Jeremy Hunt and the fun police have stepped in to stop the markets freaking out. The fallout from Kwarteng's ill-fated mini-budget has now claimed his Chancellorship[...] If you were asked to name a world-class place to surf, a field near Bristol isn’t the first location that would spring to mind. But this slice of the English countryside is home to The Wave, an artificial surfing lake that is one of just a handful in the world to use cutting edge technology[...]

If you were asked to name a world-class place to surf, a field near Bristol isn’t the first location that would spring to mind. But this slice of the English countryside is home to The Wave, an artificial surfing lake that is one of just a handful in the world to use cutting edge technology[...] When gilts hit the headlines it’s a clear sign that trouble has not only been brewing but has been unleashed. Government bond yields only tend to break through into the mainstream when things aren’t going well and they have been firmly in the spotlight since Kwasi Kwarteng’s ill-fated mini-budget. But what is a gilt, why[...]

When gilts hit the headlines it’s a clear sign that trouble has not only been brewing but has been unleashed. Government bond yields only tend to break through into the mainstream when things aren’t going well and they have been firmly in the spotlight since Kwasi Kwarteng’s ill-fated mini-budget. But what is a gilt, why[...] Rocketing rates have sent the average two and five-year fixed rate mortgage through the 6 per cent barrier. This is a level that would have been considered unthinkable a year ago, when there were 50 mortgage deals on the market at below 1 per cent. The Bank of England belatedly playing catching up with inflation[...]

Rocketing rates have sent the average two and five-year fixed rate mortgage through the 6 per cent barrier. This is a level that would have been considered unthinkable a year ago, when there were 50 mortgage deals on the market at below 1 per cent. The Bank of England belatedly playing catching up with inflation[...] As markets went haywire and the Bank of England staged a bond market intervention earlier this week, it felt like a mini-financial crisis had been triggered. It has been an incredibly turbulent week for the UK economy as the Bank of England stepped in to protect pension funds, the pound hit a record low against[...]

As markets went haywire and the Bank of England staged a bond market intervention earlier this week, it felt like a mini-financial crisis had been triggered. It has been an incredibly turbulent week for the UK economy as the Bank of England stepped in to protect pension funds, the pound hit a record low against[...] In this excerpt from the This is Money podcast, Simon Lambert and Georgie Frost discuss why the mini-Budget has combined with last week's interest rates decision to send the pound tumbling and UK government borrowing costs spiking. Find the This is Money podcast's full look at the mini-Budget and what it means for you here

In this excerpt from the This is Money podcast, Simon Lambert and Georgie Frost discuss why the mini-Budget has combined with last week's interest rates decision to send the pound tumbling and UK government borrowing costs spiking. Find the This is Money podcast's full look at the mini-Budget and what it means for you here Britain's new Chancellor Kwasi Kwarteng delivered a blistering mini-Budget this week that was anything that small. A wave of tax cuts were unleashed. Some had been heavily trailed, such as spiking the National Insurance hike and a stamp duty reduction, but there were also two rabbits out of the hat: a cut in basic rate[...]

Britain's new Chancellor Kwasi Kwarteng delivered a blistering mini-Budget this week that was anything that small. A wave of tax cuts were unleashed. Some had been heavily trailed, such as spiking the National Insurance hike and a stamp duty reduction, but there were also two rabbits out of the hat: a cut in basic rate[...] The Bank of England is tipped to raise interest rates by at least 0.5 per cent this week, but the pound fell to a 37-year low last week - reaching $1.351, a level not seen since 1985. That comes against a backdrop of inflation edging down slightly to 9.9 per cent - taking Britain out[...]

The Bank of England is tipped to raise interest rates by at least 0.5 per cent this week, but the pound fell to a 37-year low last week - reaching $1.351, a level not seen since 1985. That comes against a backdrop of inflation edging down slightly to 9.9 per cent - taking Britain out[...] This is Money's pensions guru Steve Webb racked up his 300th column answering readers' questions this week. Over the past six years, Steve, with the help of pension and investing editor Tanya Jefferies, has been guiding readers through the retirement maze - with his column regularly among the most popular stories of the week. To[...]

This is Money's pensions guru Steve Webb racked up his 300th column answering readers' questions this week. Over the past six years, Steve, with the help of pension and investing editor Tanya Jefferies, has been guiding readers through the retirement maze - with his column regularly among the most popular stories of the week. To[...] Belts are already being tightened but as bills head even higher more people will look to save where they can. But are there some things that you should avoid doing or cutting back on at all costs? Campaigns to get people not to pay their bills have obvious flaws, but what about only paying for[...]

Belts are already being tightened but as bills head even higher more people will look to save where they can. But are there some things that you should avoid doing or cutting back on at all costs? Campaigns to get people not to pay their bills have obvious flaws, but what about only paying for[...] Inflation is soaring and if predictions are correct, it would result in the Consumer Prices Index measure hitting 13 per cent this autumn. That could result in a state pension rise of around £1,000 a year to £10,900 while even at the current level of 10.1 per cent it would be upped to £10,600. However,[...]

Inflation is soaring and if predictions are correct, it would result in the Consumer Prices Index measure hitting 13 per cent this autumn. That could result in a state pension rise of around £1,000 a year to £10,900 while even at the current level of 10.1 per cent it would be upped to £10,600. However,[...] Inflation is up again with CPI now measured at 10.1 per cent, the highest since February 1982, when Margaret Thatcher was Prime Minister. How does this bout of inflation compare to then? Lee Boyce, Helen Crane and Georgie Frost discuss the higher than forecast inflation rate and what is driving it. With that rate of[...]

Inflation is up again with CPI now measured at 10.1 per cent, the highest since February 1982, when Margaret Thatcher was Prime Minister. How does this bout of inflation compare to then? Lee Boyce, Helen Crane and Georgie Frost discuss the higher than forecast inflation rate and what is driving it. With that rate of[...] Rising bills and the cost-of-living crisis are forcing many to dip into savings pots, if they have one to begin with. At the same time, with base rate rising to try and curb inflation, savings deals have become far better than they have been in the last decade. This week, Georgie Frost and Lee Boyce[...]

Rising bills and the cost-of-living crisis are forcing many to dip into savings pots, if they have one to begin with. At the same time, with base rate rising to try and curb inflation, savings deals have become far better than they have been in the last decade. This week, Georgie Frost and Lee Boyce[...] The idea of the Bank of England raising base rate by 0.5 percentage points at the same time as warning about a long and painful recession would have been unthinkable a year ago. But things have dramatically changed and central banks are desperately trying to get a grip on runway inflation that just seems to[...]

The idea of the Bank of England raising base rate by 0.5 percentage points at the same time as warning about a long and painful recession would have been unthinkable a year ago. But things have dramatically changed and central banks are desperately trying to get a grip on runway inflation that just seems to[...] This summer has seen travel demand rebound and for many, it could be their first overseas jaunt since before the pandemic. For that reason, there may be some rusty holidaymakers out there. But fear not, Lee Boyce, Helen Crane and Georgie Frost are at hand to help get you in the holiday mood (kind of).[...]

This summer has seen travel demand rebound and for many, it could be their first overseas jaunt since before the pandemic. For that reason, there may be some rusty holidaymakers out there. But fear not, Lee Boyce, Helen Crane and Georgie Frost are at hand to help get you in the holiday mood (kind of).[...] In this special bonus This is Money podcast interview, Simon Lambert speaks to Barney Whiter, whose The Escape Artist blog helps others to try to achieve the same financial independence he has. Barney tells Simon what financial independence means to him, relates how he got there and his successes and mistakes along the way, gives[...]

In this special bonus This is Money podcast interview, Simon Lambert speaks to Barney Whiter, whose The Escape Artist blog helps others to try to achieve the same financial independence he has. Barney tells Simon what financial independence means to him, relates how he got there and his successes and mistakes along the way, gives[...] Financial independence and retiring early sounds great, but could you sacrifice enough of your spending to get there? The so-called Fire movement involves living a frugal live, saving as much of your income as possible – 50 per cent or more – and investing to build a pot to retire early on. Ideally, this needs[...]

Financial independence and retiring early sounds great, but could you sacrifice enough of your spending to get there? The so-called Fire movement involves living a frugal live, saving as much of your income as possible – 50 per cent or more – and investing to build a pot to retire early on. Ideally, this needs[...]

Boris Johnson finally came unstuck this week and resigned as Prime Minister after one scandal too many caught up with him. Whatever you thought of the PM - and he certainly has the ability to divide a room almost as well as he can entertain it - there is no doubt that this ushers in[...]

Boris Johnson finally came unstuck this week and resigned as Prime Minister after one scandal too many caught up with him. Whatever you thought of the PM - and he certainly has the ability to divide a room almost as well as he can entertain it - there is no doubt that this ushers in[...] In recent times, private parking firms have come under scrutiny from motoring organisations, the Government… and This is Money. Many motorists will have received a dreaded charge in the post and in some cases, unjustifiably so. If that’s you, it’s time to fight back. This week Georgie Frost, Simon Lambert and Lee Boyce take a[...]

In recent times, private parking firms have come under scrutiny from motoring organisations, the Government… and This is Money. Many motorists will have received a dreaded charge in the post and in some cases, unjustifiably so. If that’s you, it’s time to fight back. This week Georgie Frost, Simon Lambert and Lee Boyce take a[...] A mortgage stress test designed to stop borrowers overstretching themselves will be scrapped, it was revealed this week. The mortgage industry has long bemoaned this supposedly unrealistic test that makes lenders check if borrowers can afford their repayments at a level higher than the fix or tracker deal they may be taking, their lender's standard[...]

A mortgage stress test designed to stop borrowers overstretching themselves will be scrapped, it was revealed this week. The mortgage industry has long bemoaned this supposedly unrealistic test that makes lenders check if borrowers can afford their repayments at a level higher than the fix or tracker deal they may be taking, their lender's standard[...] Base rate has gone from 0.1 per cent to 1.25 per cent in the space of six months, in a flurry of rate rising that would have been considered unthinkable a year ago. Yet, as the Bank of England delivered another 0.25 percentage point raise, voices were raised in some corners to demand why it[...]

Base rate has gone from 0.1 per cent to 1.25 per cent in the space of six months, in a flurry of rate rising that would have been considered unthinkable a year ago. Yet, as the Bank of England delivered another 0.25 percentage point raise, voices were raised in some corners to demand why it[...] Women have already been hit by a huge state pension blunder in recent years, but now it seems the DWP is messing up again. After This is Money's Steve Webb and Tanya Jefferies exposed a £1billion women's state pension scandal, which emerged from a reader question sent in to his column, you'd think the Government[...]

Women have already been hit by a huge state pension blunder in recent years, but now it seems the DWP is messing up again. After This is Money's Steve Webb and Tanya Jefferies exposed a £1billion women's state pension scandal, which emerged from a reader question sent in to his column, you'd think the Government[...] Just when you thought it was safe to go back on holiday... Britain descended into holiday chaos this week, as airlines cancelled hundreds of flights, airports struggled to cope and even Eurostar ended up with a day of disruption. For those who suffered at the hands of airline chaos, it was a harsh and unfair[...]

Just when you thought it was safe to go back on holiday... Britain descended into holiday chaos this week, as airlines cancelled hundreds of flights, airports struggled to cope and even Eurostar ended up with a day of disruption. For those who suffered at the hands of airline chaos, it was a harsh and unfair[...] Sudden Wealth Syndrome. It's a thing apparently and something that many of us probably wouldn't mind suffering from. That's the term used to describe those who suddenly - and perhaps unexpectedly - come into a very large sum of money. And doing so brings plenty of benefits but also its own problems. Over the past[...]

Sudden Wealth Syndrome. It's a thing apparently and something that many of us probably wouldn't mind suffering from. That's the term used to describe those who suddenly - and perhaps unexpectedly - come into a very large sum of money. And doing so brings plenty of benefits but also its own problems. Over the past[...] Inflation continues to surge, the Bank of England says there is little it can do to stall it but is raising rates any way, and at the same time is warning of a potential recession looming. It seems safe to say this isn’t the Covid recovery year that many people were hoping for: the longed-for[...]